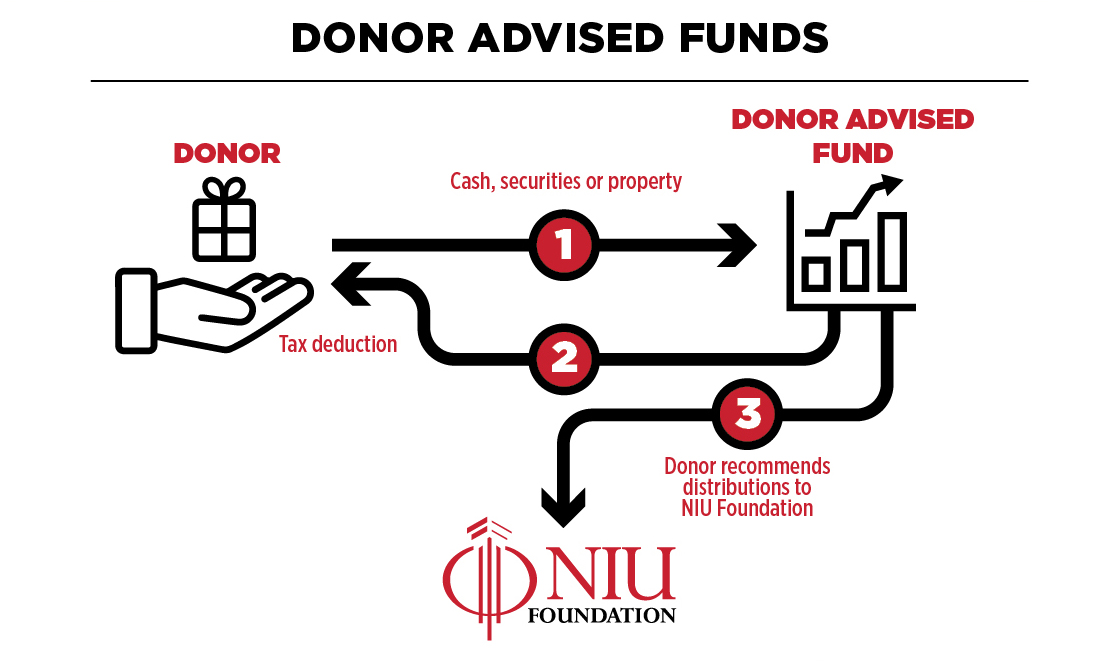

Make a Gift with a Donor-Advised Fund

The Donor-Advised Fund (DAF) is an increasingly popular way to make a charitable gift. DAFs can provide you with immediate tax benefits while making your charitable giving easier. Here are two simple ways you can make a gift through your DAF:

- Make an outright gift now by recommending a grant to Northern Illinois University Foundation.

- Create a succession plan to recommend that Northern Illinois University Foundation receive all or a portion of the fund value upon the termination of the fund.

You can select the option that best suits your philanthropic and financial goals to support the Northern Illinois University Foundation. Just contact your Donor-Advised Fund administrator to recommend a grant to NIU Foundation or to discuss a succession plan.

If you include Northern Illinois University Foundation in your plans, please let us know and be sure to use our legal name and federal tax ID.

Legal Name: Northern Illinois University Foundation

Address: Altgeld Hall, 134 DEKALB, IL 60115 USA

Federal Tax ID Number: 36-6086819